What Is Off-Payroll Working? IR35 Explained for the UK Employers

IR35 is a set of tax legislation in the United Kingdom designed to combat tax avoidance by workers supplying their services to clients via an intermediary, such as a limited company, who would otherwise be deemed employees. The rules ensure that individuals working similarly to employees pay broadly the same tax and National Insurance contributions as if they were employed.

IR35, also called the off-payroll working rules, determines the employment status of individuals providing services through their own company for tax purposes.

In this article, we will explore the implications of IR35, what it means for contractors and businesses in the UK, and how to navigate the complexities of this tax regulation.

What Is IR35 in the UK?

IR35 is a set of tax legislation introduced in the UK to combat tax avoidance by individuals who provide their services through an intermediary, such as a limited company or partnership. This legal framework is officially known as the off-payroll working rules.

The term "IR35" derives from an original press release published by the UK tax authorities in 1999. The rules took effect in April 2000 through the Finance Act 2000 (Schedule 12).

The core purpose of IR35 is to ensure that workers who would be considered employees if the intermediary was not used pay roughly the same income tax and National Insurance Contributions (NIC) as if they were directly employed.

The critical aspects of IR35 include:

Determination of Employment Status: IR35 requires assessing whether the individual would be employed or self-employed for tax purposes if the intermediary did not exist.

Liability: If the rules apply, the 'fee-payer', often the client, is responsible for deducting the appropriate taxes.

The legislation impacts both the public and private sectors, where the determination process varies slightly. This emphasises the client's responsibility to assess the working relationship with the contractor. Failure to comply with IR35 can lead to significant tax liabilities, underscoring its importance in contractor tax affairs.

Further Reading: Payroll Number

When Does IR35 Apply?

IR35, also known as off-payroll working rules, applies in specific circumstances. The legislation aims to identify individuals who are essentially employees but are operating through an intermediary, such as a personal service company (PSC), to avoid paying employment taxes.

Individuals Providing Services Through Intermediaries: IR35 concerns individuals who do not meet the criteria for self-employment for tax purposes and are working through their intermediary, such as a PSC, a partnership, or an individual.

Determining Factors: The legislation considers whether, if the intermediary were not used, the individual would be regarded as an employee of the client. Factors include control, substitution, and mutuality of obligation to ascertain employment status.

Client's Responsibility: Since April 2021, it has been the client's responsibility in the private sector to determine the worker's status and convey this decision down the supply chain.

Self-employed Definition: Self-employed professionals may be outside IR35 if they are genuinely in business on their account, and their working arrangements reflect this.

Implications for Self-employed: If the rules apply, they affect how the worker is taxed and can lead to a deemed employment payment at the end of the tax year.

Exceptions: Small private sector clients are exempt; hence, the worker's intermediary determines the IR35 status.

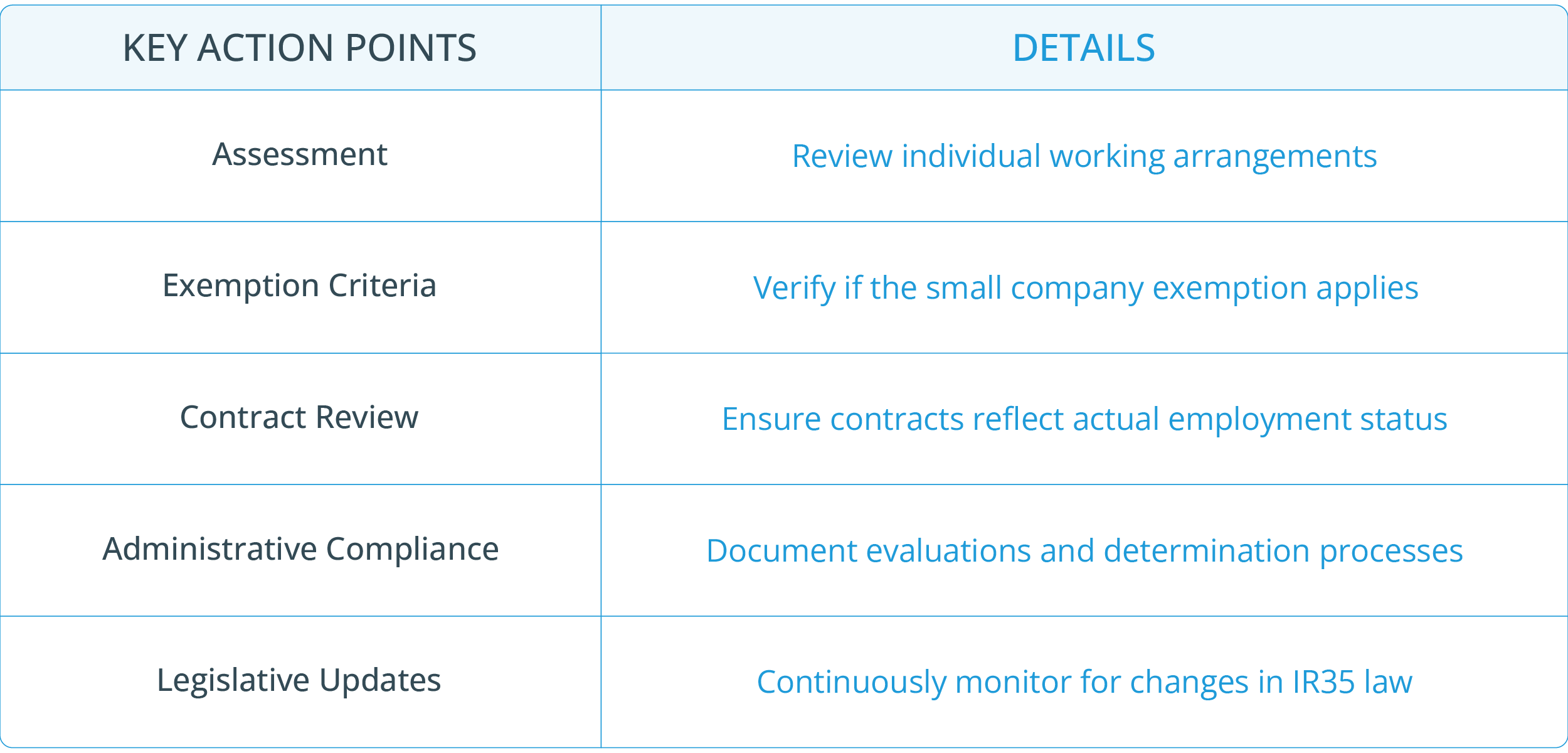

5 Key IR35 Regulations Employers Should Be Aware Of

Identify and Evaluate Working Arrangements

Employers should assess whether IR35 applies to their contractors. Companies need to determine if a contractor is genuinely self-employed (outside IR35) or an employee for tax purposes (inside IR35) by considering factors like control, substitution, and mutuality of obligations.

Comply with Small Company Exemption Criteria

Small companies may be exempt from IR35. To qualify, a company must meet at least two of the following conditions:

Annual turnover under £10.2 million

Balance sheet total under £5.1 million

No more than 50 employees

Review Contractual Terms and Employment Status

Contracts with contractors must be reviewed to ensure they accurately reflect the working relationship. Employers are responsible for determining the employment status and should update contracts to define the correct status of each worker.

Implement Administrative Processes

Employers should establish clear administrative procedures to evaluate the contractors' status compliantly, including documentation of the decision-making process.

Keep Up to Date with Legislation Changes

IR35 regulations can change, and employers must stay informed about current rules and any upcoming amendments to maintain compliance.

What Is Inside IR35?

Inside IR35 refers to the UK tax legislation determining whether a contractor is effectively an employee when working for a client. This classification has significant tax implications for the contractor.

Key Factors determining inside IR35 status:

Supervision and Control: A high level of supervision and the client's ability to dictate how work is done may indicate employment.

Substitution: The inability to send a substitute in the contractor's place can be a sign of employment.

Mutuality of Obligation (MOO): An obligation for the client to provide work and the contractor to accept it can signal employment.

Contractors who fall inside IR35 must pay income tax and National Insurance Contributions as if employed. If the client is a medium or large private sector company, the fee payer is responsible for determining IR35 status and deducting appropriate taxes. For small clients, it is the contractor's own company's responsibility to make this determination.

Inside IR35 essentially means that contractors:

Are treated for tax purposes as employees.

Lack the tax benefits associated with running their own limited company.

Being classified as inside IR35 leads to a higher tax liability for the contractor, reducing net income.

UK IR35 legislation aims to prevent tax avoidance by individuals providing services via intermediaries such as personal service companies when, if not for the intermediary, they would be employees.

What Is Outside IR35?

When a contractor's arrangement with a client is described as outside IR35, it indicates they are not subject to the Off-Payroll Working Rules (IR35). This means they are considered genuinely self-employed for tax purposes and are operating as an independent business.

Criteria for Being Outside IR35:

Control: Contractors have autonomy over how they complete their work.

Substitution: They may send a substitute in their place.

Mutuality of Obligation: Neither party must offer or accept future work.

Financial Implications:

Allows contractors to be paid through their own limited companies.

Typically, they can draw a combination of salary and dividends, leading to potential tax efficiencies.

Being outside IR35 is beneficial for contractors from a financial standpoint, as it can result in a lower tax burden than being an employee or inside IR35. However, the responsibility often lies with contractors to demonstrate their status outside of IR35, particularly since the 2017 and 2021 changes, when in many cases, this responsibility shifted to the client in the public sector and medium-to-large private sector companies, respectively.

Contractors should seek periodic contract reviews and maintain compliant working practices to ensure their status remains outside IR35.

How Has IR35 Changed in Recent Years?

IR35, a UK tax legislation, is designed to combat tax avoidance by workers supplying their services to clients via an intermediary, such as a limited company, who would otherwise be an employee.

The legislation has undergone significant changes in recent years to refine how contract workers are taxed and how compliance is enforced.

In 2017, the UK government shifted responsibility for IR35 status determinations from contractors to the public sector bodies employing them.

This change meant that these organisations were now tasked with assessing whether contractors should be taxed like employees.

April 2021 saw these changes extend to the private sector.

For medium and large companies, the onus to determine the IR35 status of contractors transitioned from the contractors themselves to the companies that hired them.

This shift led to many individuals being classified as 'deemed employees,' often resulting in higher tax and National Insurance contributions.

Changes have continued with announcements in the mini-budget of September 2023.

From April 6, 2023, the government repealed the reforms previously extended to the private sector, effectively shifting the determination responsibility back to the contractors.

These reversals came after feedback from businesses and stakeholders highlighting complexities and challenges posed by the reformed IR35 legislation.

The government has set April 6, 2024, as another date for change.

Proposed amendments aim to simplify the compliance process, but specifics are pending, suggesting a continued evolution of the IR35 landscape.

These developments highlight the government's ongoing response to stakeholders' concerns and the evolving nature of employment practices.

Key Takeaways on Off-Payroll Working Rules in the UK

The IR35, known as off-payroll working rules, seeks to address tax avoidance by ensuring that individuals who work like employees through their own company pay similar taxes as regular employees.

Instances where the IR35 does not apply, include working arrangements that do not disguise employment and are genuine business-to-business engagements.

Employers should familiarise themselves with the legislation and exercise due diligence in determining the status of their contracts and relationships with contractors.

FAQs

When Did IR35 Start?

IR35 was introduced in April 2000. It was enacted to address tax avoidance through the use of intermediaries such as Personal Service Companies (PSCs).

What Are Tax Avoidance Schemes Aimed at Contractors and Agency Workers?

Tax avoidance schemes aimed at contractors and agency workers are designed to disguise employment to avoid paying taxes and National Insurance contributions. IR35 guidance seeks to ensure that workers, who would have been deemed employees if they had been contracted directly, pay broadly the same tax and insurance as employees.

How to Recognise if a Worker Is Employed for Tax Purposes?

A worker is employed for tax purposes under IR35 if, without the intermediary, their relationship with the client resembles employment. Factors include control over how work is done, substitution options, and if they are taking significant financial risks.

What Is an IR35 Contract?

An IR35 contract refers to a written agreement detailing a worker's terms with a client, typically via an intermediary like a PSC. This contract should accurately reflect the working practices to determine the IR35 status. IR35 rules for self-employed are applied according to the actual working relationship, not just the contract terms.

Does IR35 Apply to Non-UK Residents?

IR35 can apply to non-UK residents if they work for a UK client through an intermediary, although specific conditions must be met, including how the work is performed and controlled.

Are Freelancers outside IR35?

Freelancers may be considered outside IR35 if they are genuinely self-employed, meaning their working practices and contract terms demonstrate they are in business on their own account and don’t fall within the legislation’s definition of 'disguised employees'.

Do Non-Resident Overseas Employees Pay UK Tax?

Non-resident overseas employees may have to pay UK tax on UK earnings, but this depends on several factors, including their residency status and where the work is carried out.

For those working in the UK, the UK IR35 rules could apply if the working arrangement resembles employment.