How to Calculate Holiday Pay for Casual Workers in the UK? Full 2024 Guide

Holiday pay for casual workers is important in employment law and human resources management.

Unlike traditional employees with set hours and salaries, casual workers' compensation can vary widely, creating challenges in determining fair holiday pay.

Calculating this pay necessitates understanding average earnings over a designated period, typically factoring in the last 52 weeks of work.

In this article, we will explore how holiday pay for casual workers is assessed, the legal standards that govern it, and the mechanisms for ensuring fair compensation.

Are Casual Workers Entitled to Holiday Pay in the UK?

In the United Kingdom, casual workers are entitled to holiday pay. This entitlement is protected by law regardless of their informal employment status.

Casual workers can calculate their paid holiday entitlement based on their hours worked, following a standard formula provided by the government.

This calculation is an integral part of employment rights, ensuring casual workers are not excluded from benefits typically associated with more permanent roles.

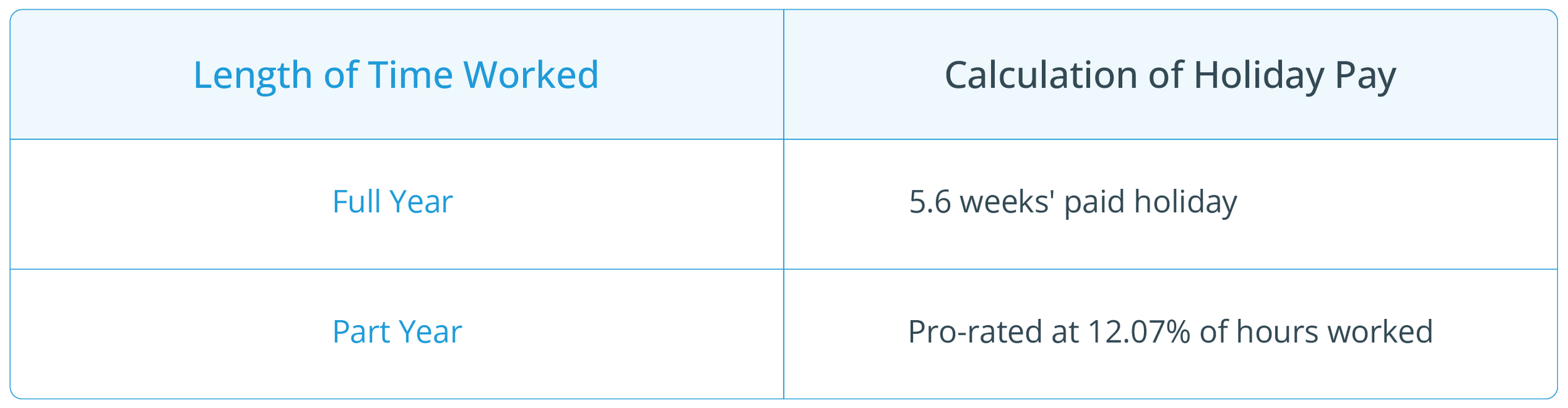

Casual workers' holiday pay should be equivalent to their average pay during the employment period. Below is a simplified representation:

Casual workers must understand that while they are entitled to paid holiday, accurate record-keeping by employers is pivotal to determining the correct amount due.

This consideration ensures compliance with UK employment regulations, providing a fair work environment for casual and seasonal workers.

Employers are also responsible for maintaining detailed records of the hours worked by casual workers. These records serve as the basis for correctly calculating holiday pay, allowing workers to enjoy the equivalent financial benefit of their service when taking time off.

Further Reading: Zero Hours Contract Holiday Pay

UK Laws for Casual Workers' Holiday Pay

Legislation in the United Kingdom ensures that casual workers receive fair holiday pay. Regardless of their hours or contract type, casual workers are entitled to paid statutory holidays based on the amount of work they perform.

Statutory Holiday Entitlement

Casual workers are covered by the legal framework for holiday entitlement, which, from 1 January 2024, includes reforms specifically addressing the calculation of their holiday pay.

Leave Year Reforms: For leave years starting from 1 April 2024, casual workers with variable hours or part-year contracts are eligible for up to 5.6 weeks of paid holiday.

Calculation Method: The amount of holiday pay for workers without fixed hours or pay is determined by calculating their average pay over a reference period.

Accruing Holiday Pay

The accrual of holiday pay is proportionate to the hours worked.

For instance, a worker’s pay is averaged over the 52 weeks preceding the holiday period.

Rate of Pay

For non-fixed-hours workers, the required holiday payment is their average pay rate.

Regular Hours Work: If hours are consistent, the holiday pay equates to the usual rate, such as a £400 weekly payment for a 37-hour week.

No Normal Hours: Those without standard hours are based on an average of pay received during the prior 52 weeks, excluding any weeks not worked.

How to Calculate Holiday Pay for Casual Workers: 5 Tips

Tip 1: Understand the Basis of Calculation

Casual workers' holiday pay is typically based on the average hours worked.

For accurate calculations, it's crucial to tally the hours worked in the preceding 52 weeks for an average. If the worker has not been employed for a full year, the employer should use the total weeks available.

Tip 2: Avoid the Pitfalls of Incomplete Data

An employer must ensure that all the hours worked by the casual staff are correctly recorded. Missing data can lead to underpayment, which can result in potential legal consequences.

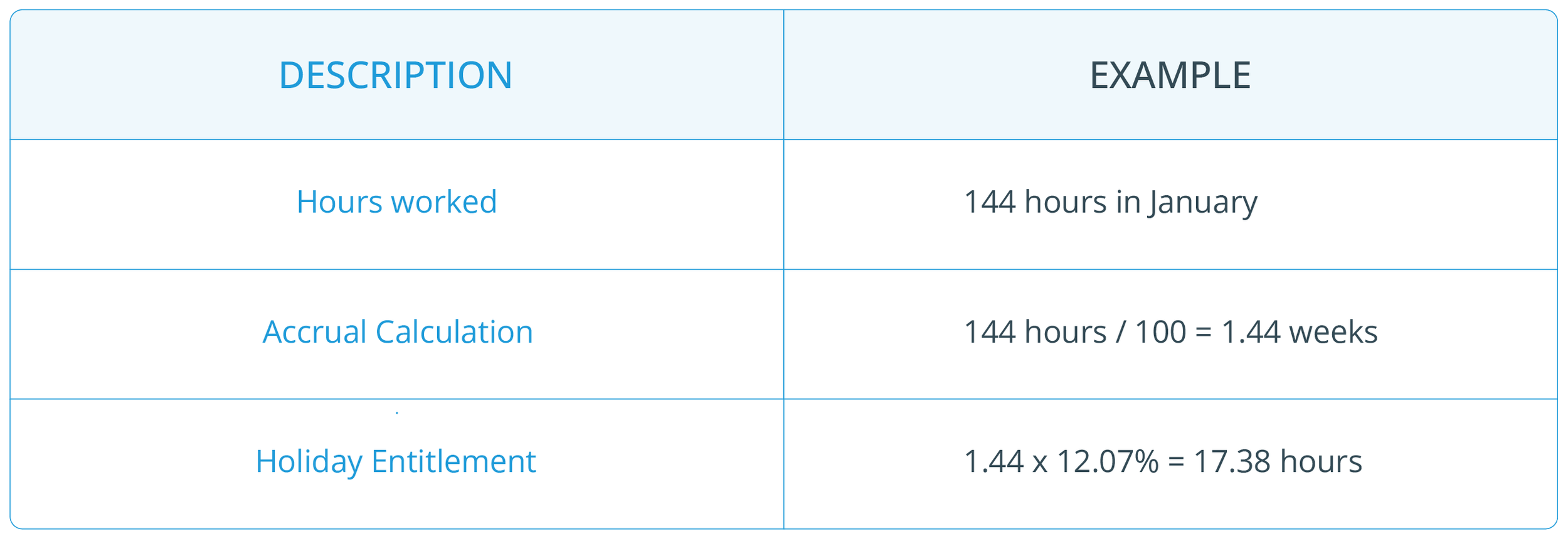

Tip 3: Utilize the Percentage Method

A helpful calculation is the 12.07% method, where 12.07% represents the proportion of the statutory holiday entitlement to the working year.

Employers can multiply the total hours worked by the casual staff by 12.07%.

Tip 4: Calculate Weekly Pay Where Applicable

When casual workers have a pattern of consistent hours per week, holiday pay can be calculated by determining the average weekly pay:

Weekly holiday pay = Sum of last 52 weeks' pay / 52.

Tip 5: Recognize Variations in Holiday Rate

Casual workers may receive a different hourly rate during holiday periods.

Employers should multiply the normal hourly rate by the holiday rate to calculate holiday pay for the actual hours worked during the holiday.

Casual Worker Holiday Pay Calculator for the UK

In the United Kingdom, calculating holiday pay for casual workers follows specific guidelines stipulated by the government. The holiday entitlement for workers is typically 5.6 weeks per year.

For casual workers whose hours are not fixed, their pay during their holiday is based on the average number of hours worked in a set reference period.

Traditionally, this reference period has been the 12 weeks leading up to the holiday. However, recent updates have extended this reference period to 52 weeks to ensure a fairer representation of their working pattern.

An easy method of calculating holiday pay is the percentage method, where 12.07% is the standard percentage of the hours worked.

This figure derives from the standard working year of 46.4 weeks (52 weeks minus 5.6 weeks holiday), with 12.07% representing the proportion of the holiday relative to the working year.

Example of the Calculation:

Total hours worked in the reference period: 130 hours

Total pay in the reference period: £1,250

Average hourly pay: £1,250 / 130 hours = £9.62

Holiday pay for a typical week would be:

25 hours x £9.62 = £240.50

Employers may use software tools to automate the calculation, ensuring all variables are accounted for, and the process complies with legal requirements.

It is essential also to note that any changes in legislation are monitored and calculations adjusted accordingly.

The pay calculation includes bank holidays as part of the statutory holiday entitlement. Employers are advised to review any updated guidelines from GOV.UK or Acas to ensure compliance with current regulations.

Further Reading: Holiday Pay When Leaving a Job

Key Takeaways on Calculating Holiday Pay for Casual Workers

For casual workers without fixed hours or pay, calculating holiday pay requires a different approach than for salaried employees.

The following principles often guide employers:

Reference Period: Typically, employers look at the average hours worked over a 12-week reference period to calculate holiday pay. This accounts for fluctuations in working hours.

Hourly Rate: To find the hourly rate for workers without fixed pay, total earnings are divided by the total hours worked in the reference period.

Percentage Method: While previously popular, calculating holiday entitlement as 12.07% of hours worked is now considered outmoded post-Brazel v The Harpur Trust (2022). Employers should carefully consider this precedent when determining holiday pay.

Statutory Entitlement: Regardless of hours worked, all workers are entitled to 5.6 weeks of paid holiday per year, which can be proportionally adjusted for part-time workers.

FAQs

Do Zero-Hour Contracts Get Holiday Pay in the UK?

Yes, individuals on zero-hour contracts in the UK are entitled to holiday pay. They accrue holiday time in proportion to their work hours, equating to a statutory minimum of 5.6 weeks paid annual leave, calculated on their average earnings over a reference period.

Do Employers Have to Pay Holiday Pay to Zero Casual Workers in the UK?

Employers must provide holiday pay to casual workers, including those on zero-hour contracts. The amount is typically based on the average pay received by the worker in the previous 12 weeks in which they were paid.

What Are the Working Time Regulations?

The Working Time Regulations establish legal limits on workers' work hours in the UK.

The rules afford workers the permissible amount of daily and weekly rest and cap the average workweek to 48 hours. Workers may choose to opt out of this limit voluntarily.

Do Bank Staff Get Holiday Pay?

Bank staff, or those on bank-hour contracts, are also eligible for holiday pay. Their entitlement is usually based on their hours, and they accumulate paid holiday time akin to other types of workers.

Do Casual Workers Need to Be on Payroll?

Casual workers should be on the payroll to ensure accurate holiday pay calculation and payment.

They must receive payslips that detail their pay and any deductions, ensuring transparency in their compensation, including holiday pay.