Employee types and classification: how to correctly classify employees in the United States

As an entrepreneur, CEO, or human resources manager, it’s your legal duty to properly classify every member of staff on your team. However, the truth is that determining whether an employee is exempt and non-exempt under FLSA guidelines can be complicated and time-consuming, especially if they fall within particular thresholds or perform multiple duties.

Failing to classify employees correctly could result in legal action against your firm, so it is important not to put it off and make it your aim to properly classify employees as soon as they enter your payroll - and update their classification should the terms or hours of their employment change down the line. Below, we offer some guidance on doing exactly that…

Why employee classification matters in the United States

According to government statistics, total wage and hour payments caused by unpaid overtime clock up to around US$400 million per year - and companies have to spend, on average, US$5.3 million to solve a case. As a business owner, it’s your responsibility to ensure you comply with the FLSA and classify all of your employees correctly. If you don’t, you’re not only doing your staffers a disservice by underpaying them, but you’ll likely be investigated and have to face officials - which can be stressful, costly, and time-consuming.

Most companies are good at classifying non-exempt positions, such as receptionists, assistants, and other low-paid or hourly-paid workers, but the waters become a little murkier when classifying exempt workers. Indeed, it’s common for employees to want to be exempt for security and peace of mind, though there are benefits to non-exempt classifications (most importantly, being eligible for overtime, though salaries usually trump hourly wages).

The difference between exempt and non-exempt employees

In the United States, there are two types of employees:

Exempt employees: The Fair Labor Standards Act does not protect exempt workers from overtime, meaning they’re not entitled to overtime pay in their role. That means if an employee is assigned a task and it takes them 60 hours rather than the 40 hours they’re salaried for, they’re expected to finish those responsibilities without overtime. Of course, there are exceptions to this rule, and other labor laws can override this.

Nonexempt employees: Nonexempt employees, on the other hand, must earn at least the minimum wage for the number of hours they work. If they’re usually paid for 10 hours but work for 12, they’re entitled to receive an additional two hours’ salary. For nonexempt employees who work for more than 40 hours per week, employers must pay them time and a half of their regular hourly wage if they work any overtime.

The benefits and drawbacks of exempt/non-exempt

Exempt workers benefit from calculating near-exact amounts of annual or monthly wages so that they can budget accordingly and pay for a mortgage, organize trips away with their families and more. Non-exempt workers, on the other hand, may not know how many hours they will work from month to month, or work fewer overtime hours than they had anticipated.

On the other hand, non-exempt workers are able to increase their monthly pay packet by working longer shifts, whereas exempt workers are expected to show up from 9 am to 5 pm five days a week for the same fixed salary per month, bonuses and pay rises aside.

Determining whether an employee is exempt or nonexempt

Generally speaking, companies pay their exempt workers for the job they do rather than the number of hours it takes them to do it. In order to qualify as an exempt employee, however, they must meet the following criterion:

They’re paid on a salary basis.

They earn more than US$47,476 per year or US$913 per week.

They perform exempt job duties (outlined below).

Typical duties assigned to exempt workers include executive duties, administrative duties, outside sales duties, or learned/creative/computer professional duties.

Changing an employee’s classification

From time to time, you may decide to change an employee’s classification, though it can be difficult to break the news to someone who would prefer to be exempt. We recommend that you are firm and fair with your reasoning, letting your employee know that you’ve conducted an audit of classifications and that, based on current duties, their position was incorrectly classified. Let them know that they’ll be paid hourly rather than salaried and that they’re now eligible for overtime pay - or vice versa if a staffer becomes eligible for a full-time salary.

Considering local laws

Depending on your state, you may need to take into account local laws when determining whether an employee is exempt or non-exempt. Indeed, last year, the California Supreme Court adopted the ABC test, which presumes workers in “gig economy” jobs are employees. This means that US companies can no longer dodge the minimum wage laws by pretending that freelancers or ‘gig economy’ employees are somehow not their employees, and therefore have to pay them a fair wage and the associated benefits of being employed.

In Texas, on the other hand, workers in the ‘gig economy’ are more likely to be treated as independent contractors than employees, and so are responsible for paying their own tax, insurance, and paying for their own training, development, and equipment. For companies with offices in more than one state, factoring in local laws will allow you to remain compliant and maximize profitability and productivity by incorporating gig workers into their operations where possible, whilst considering the legal and financial consequences of doing so.

Avoid these common classification mistakes

When classifying employees in the US, it’s important to avoid these common mistakes:

Forgetting the working relationship: Consider the amount of control your worker or employee has over the work they perform. The IRS considers factors such as Behavioral (how much control you have over your employees), Financial (How much control you have over the business aspects of your worker’s role) and Type of Relationship (the IRS reviews contracts, benefits, duration, and type of work).

Relying solely on written contracts: Whilst you should take into consideration any contract or documentation regarding their role, you must also think about the nature of the working relationship between you and your worker. It’s easy to assume a contract defines a worker’s classification. It does, but the IRS will think differently if the nature of your working relationship is different from that of the contract.

Investments: According to the IRS, a ‘significant investment’ in job training and equipment suggests a worker is an independent contractor rather than an employee, though in some cases, both parties may have invested in training and equipment. Deciding on the right classification really depends on the size of the investment, as well as whether the company reimburses the worker for those expenses and investments. Use your best judgment when classifying an employee in this case.

Payment methods: Another common mistake businesses make when classifying employees is assuming that workers paid hourly or on salaries are employees, and workers paid a flat fee are contractors. That’s usually the case, but contractors can also be paid hourly, particularly in construction and project-based circumstances.

Using benefits to determine classification: Finally, don’t use benefits to determine the classification of a worker. Whilst most employees are offered benefits such as sick days and health insurance, that doesn’t mean contractors can’t be offered such benefits - and vice versa. Take everything into account and remember that you must remain compliant with the Affordable Care Act (ACA), amongst other legislation.

There’s no denying that it can be difficult to classify employees, particularly if they form part of the gig economy or their working relationship is different from that on their contract. Use your best judgment and seek professional human resources support to ensure you’re fully compliant - and remember that employees’ rights (and not profitability) should come first.

How PARiM makes employee classification insanely simple

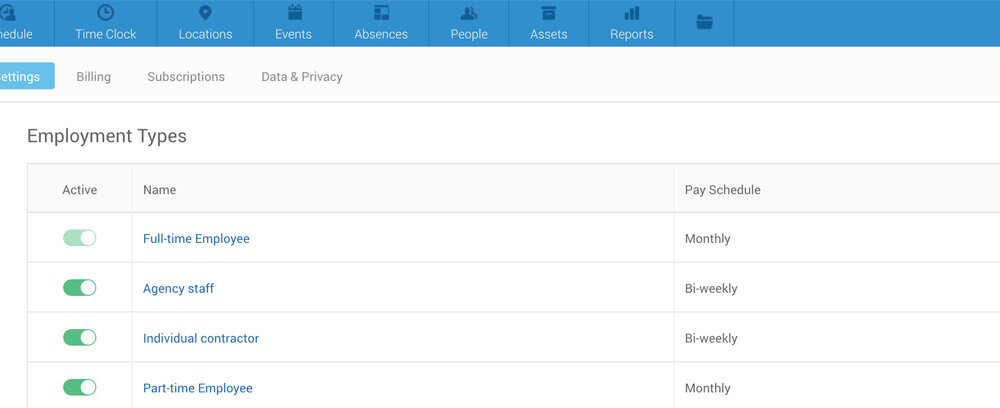

The latest release of our workforce software adds the ability to add an infinite variety of ways to classify employees, which we call Employee Types. Read more about it here.

For each type of employees you can add different pay periods (weekly, fortnightly, monthly etc..), working time rules, choose whether absences should be tracked and much more.